2025 Federal Tax Brackets Married Joint Single. The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the. The new standard deduction for married couples filing jointly will rise to.

There are seven tax brackets for most ordinary income for the 2025 tax year: The standard deduction is also increasing 5.4% in 2025, the irs said.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, Operates on a progressive tax system,. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

2025 Tax Brackets Married Jointly Single Cherye Juliann, For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the 22% bracket for. The top marginal income tax rate of 37% will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married couples filing.

2025 Tax Brackets Married Jointly Kelli Melissa, The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married couples filing. The tax brackets consist of the following marginal rates:

Tax Brackets 2025 Single Filing Erma Benedetta, 2025 standard deduction over 65 tax brackets. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married couples filing.

Tax Brackets 2025 Single Vs Married Row Hedvige, For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the 22% bracket for. It is mainly intended for residents of the u.s.

2025 Tax Brackets Married Filing Jointly Irs Dyana Cristal, Us tax brackets 2025 married filing. And is based on the tax brackets of.

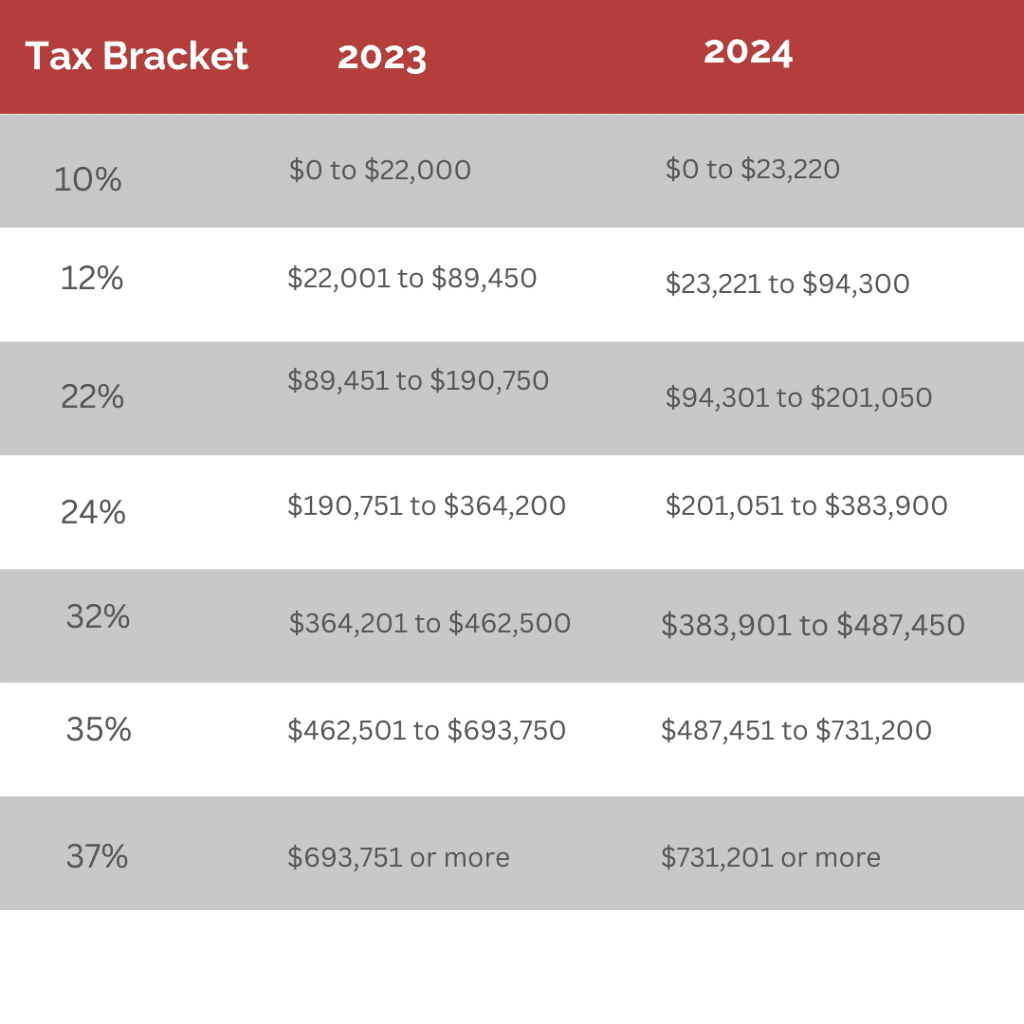

2025 Tax Brackets Married Jointly Kelli Melissa, The federal income tax rates remain unchanged for the 2025 tax year at 10%, 12%, 22%, 24%, 32%, 35% and 37%. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

Tax Brackets 2025 Irs Single Elana Harmony, This bracket applies to income of $578,125 or more for single filers, or. The agency adjusts the tax brackets using a.

Tax Bracket Changes 2025 For Single, Household, Married Filling, In 2025, the federal income tax rates consist of seven brackets: Yep, this year the income limits for all tax brackets will be adjusted for inflation, so let’s take a closer look at what tax rates and tax brackets are and how they change how much you pay in federal income.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers and. 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers and.

Chinese Zodiac For The Year 2025. As 2025 is the year of the wood dragon, bringing with it a tide of change, here's how each chinese zodiac is affected midway

Ups Layoffs 2025. Ups said it will lay off 12,000 employees. New york cnn — ups announced tuesday that it will cut 12,000 jobs as part of a bid to

Last Day Of School Bcps 2025. The first day of school will be monday, aug. Meet the teacher nights (days and times vary by school) august 21: Today is bittersweet